Digital Transformation

Industries

Services

About us

Insights

- Careers

- Resources

- Contact us

As AIK Bank’s business grew and customer base expanded, there was a need to further improve the company’s IT infrastructure. The Bank recognized that it needed to implement a Disaster Recovery solution to be able to guarantee a higher level of availability and added security to its customers.

In light of the new regulations issued by the National Bank of Serbia, AIK Bank had to implement a Disaster Recovery (DR) solution in its business operations.

In today’s highly competitive banking market, having a DR plan is no longer an option, it’s a necessity. AIK Bank knows that every minute its system is down, it could lead to potential revenue loss, not to mention reputation damage and loss of standing with its clients. As one of the leading banks on the Serbian market, it was important for AIK Bank to provide its customers with peace of mind that they can always count on their services.

To do this, AIK Bank needed to improve its existing IT system and implement a robust DR solution, which would ensure that unplanned outage of all or any part of the IT system would not impact the Bank’s employees and customers.

One of the main challenges was the creation of procedures for the implementation of a DR solution in the Bank’s vast IT system. It was necessary to implement the solution without any interruptions or changes to the IT system. Furthermore, the DR procedures had to be highly automated and segmented according to services. The biggest challenge was enabling the recovery of individual services or the entire IT system in just a few clicks and transferring services or the entire system to the secondary data center in the shortest amount of time possible, with minimal disruptions to services.

AIK Bank decided to engage Comtrade System Integration for the job based on the best price, quality of service, as well as previous successful cooperation between the two companies.

“Based on the previous work Comtrade System Integration has done for us, we had no hesitation engaging their team for this project.”

Milan Pavlovic

Head of System Support, AIK Bank

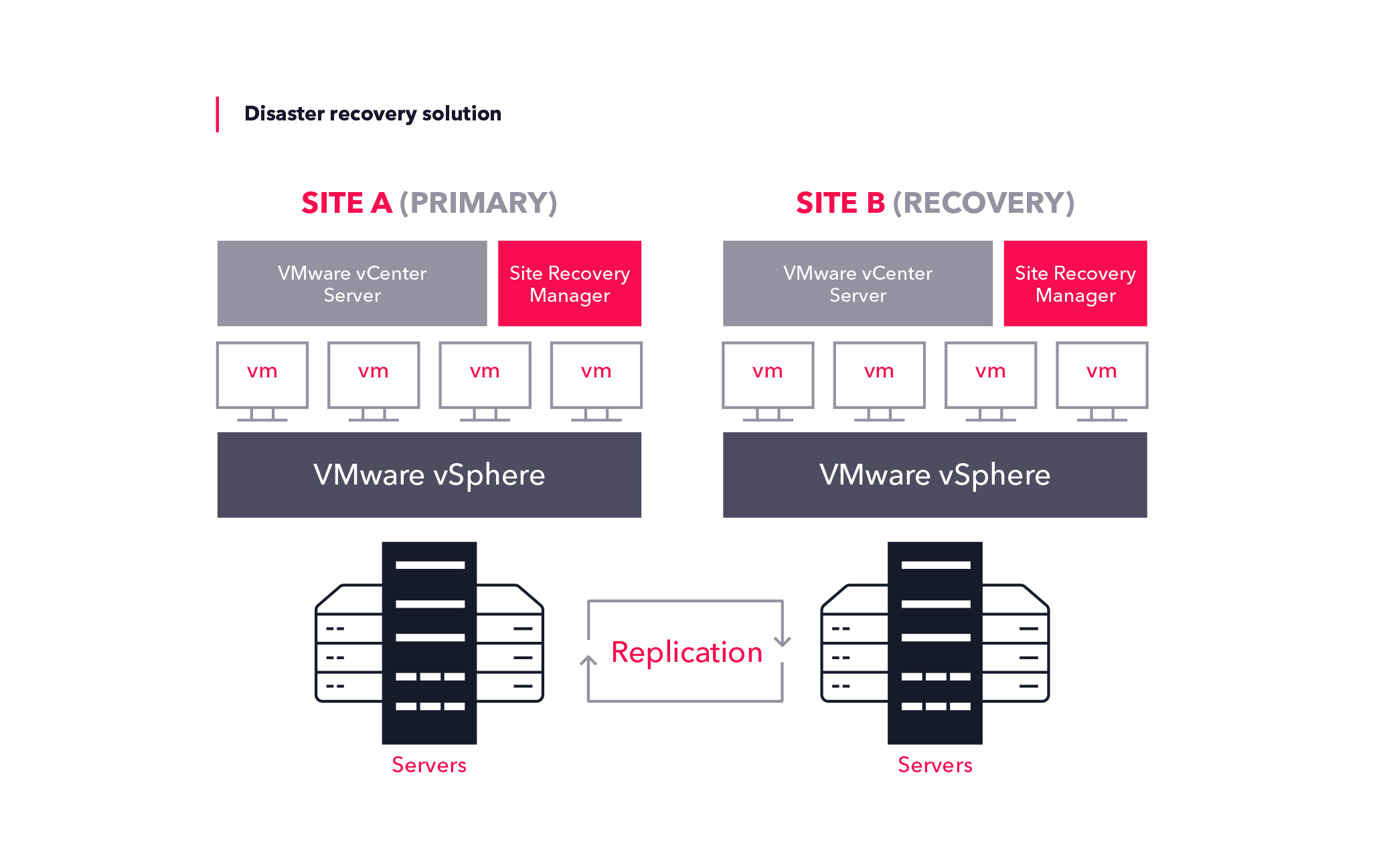

After analyzing AIK Bank’s IT infrastructure, Comtrade SI recommended a software solution that is capable of meeting all of the client’s requirements – Vmware’s Site Recovery Manger (SRM).

SRM, a leading disaster recovery software on the market, is designed for the automation of DR procedures. The product enables replication of a server from one data center to another, bi-directional replication, starting up the entire IT system or only a part of it in just a few clicks, while making required changes to all services so they can be seamlessly transferred to the secondary data center with little disruptions to the services. The implementation of the SRM solution was divided into two stages – first at the primary data center and then at the secondary data center location.

Among other reasons, SRM solution was chosen because it enabled Comtrade SI to test all DR procedures within an isolated network and without causing downtime for the Bank’s clients and employees.

Our prior work with AIK Bank set the grounds for the DR solution implementation. Prior to SRM, Comtrade SI successfully completed several projects for AIK Bank, including migration from Hyper-V platform to VMware platform, consolidation of physical servers to a virtual environment, reconfiguration of storage systems at the primary site and configuration of the new server and storage system at the disaster recovery site.

The experience of Comtrade SI combined with close cooperation with AIK Bank was invaluable in creating a success story: an enhanced IT system and a robust Disaster Recovery solution, which strengthened the Bank’s IT resiliency. Furthermore, the solution allowed AIK Bank to gain additional benefits and do much more than originally required.

The greatest benefits are automation, platform stability and 24/7 system availability. Now, AIK Bank is able to provide its customers with an additional level of security and higher levels of service availability. In the event of a natural disaster, service outage or IT system failure, downtime is minimal enabling employees and customers to do business as usual.

Successful completion of the project and a good working relationship resulted in a maintenance contract and further cooperation between AIK Bank and Comtrade SI.

Founded in 1976, for almost two decades AIK Banka AD Beograd was the internal bank of Agroindustrijski kombinat Niš. In the 1990s, the bank started commercial operations and began providing universal banking services. In the same period, the bank went public and its shares were listed on the Belgrade Stock Exchange. Today, the bank has more than 6,000 shareholders and for years now its shares have been among the most liquid securities traded on the Belgrade Stock Exchange. With over EUR 620 million in savings, the bank is recognized as a reliable partner in both retail and corporate sectors.