Digital Transformation

Industries

Services

About us

Insights

- Careers

- Resources

- Contact us

Credit Impairment Management System (CRIMS) is a modern risk, finance and management solution, designed to solve problems inherent to complex credit impairment measurement, management and decision-making processes. An ever-increasing unpredictability of the credit business environment demands fast and agile responds from banks: let us help you with this highly interactive and flexible solution.

The IFRS 9 impairment standard introduced unprecedented complexity in banking and altered the fundamental nature of how credit default risk is calculated. To overcome this challenge, banks need a solution that enables a seamless process and workflow configuration, as well as calculation parametrization.

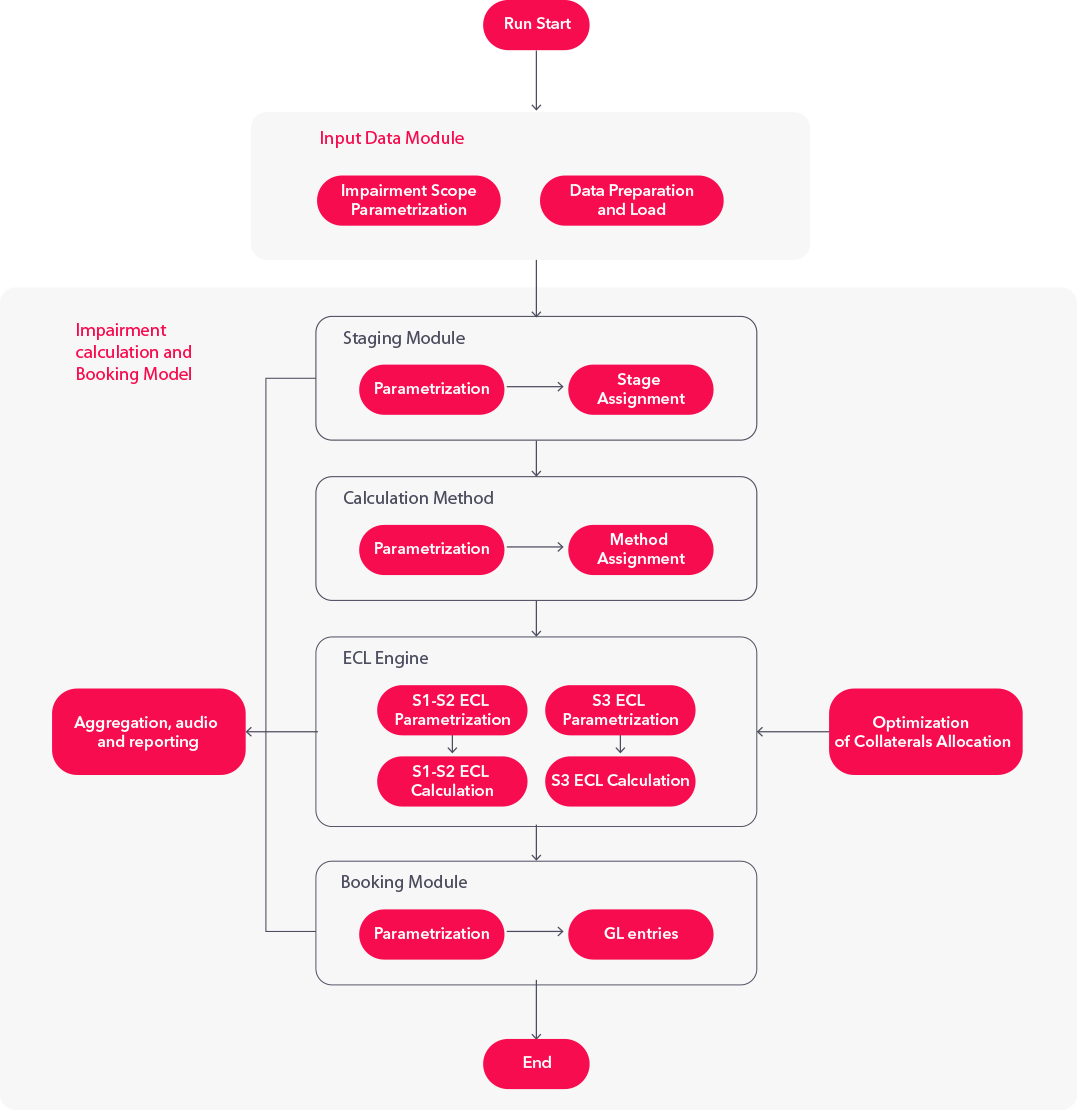

The following figure summarizes a general process and a core set of CRIMS modules used to estimate credit impairment under the IFRS 9 standard: