Digital Transformation

Industries

Services

About us

Insights

- Careers

- Resources

- Contact us

In the last couple of years, digital banking has raised clients’ standards and expectations in our market. The arrival of new generations – those who value digital products much more than physical proximity of a bank – requires of these institutions to change and actively engage in the process of digital transformation. Today, clients want all banking products to be available online – without going to the bank or waiting in line – via an app or a website. Inefficient and complicated processes, for example, while applying for a loan, lead to clients often being ready to even change banks, just so they could avoid traditionally slow systems.

The enlargement of the banking industry, due to insufficient flexibility of smaller banks, lower quality of their services, high fixed costs and insufficient IT investments, additionally slows down the process of digitalization and introducing of new business models. The question that people think about is – where to start the process of digital transformation? What business processes should they optimize and automate first, so the effects are seen as soon as possible?

The answer to all mentioned challenges is the digitalization of banking industry: that is, creating an internet sales channel for banking products and services, along with implementation of a video identification system for remote business cooperation.

Imagine that a potential client could choose the loan, deposit, account or card option they want, and then – with just a couple of clicks on their mobile device – could receive the bank offer, go through the process of video identification, sign the contracts using the system of two-factor authentication and activate the service!

Our system efficiently recognizes the current client status in the bank, and sets a minimal number of steps they have to go through in order to receive the product. The customer enjoys great user experience, while the bank saves resources that would ordinarily work on managing and realizing the request.

The digital channels become a central meeting point for clients, while bank employees can use their time for upsell and cross-sell activities, focusing on existing clients and acquisition of new users.

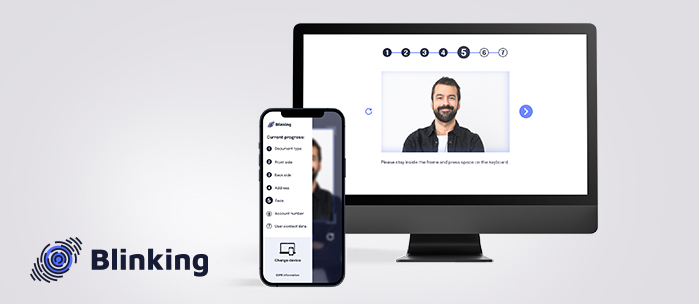

The digital bank was created in cooperation with Blinking company, whose technology allows development of complex banking products based on user identity confirmation.

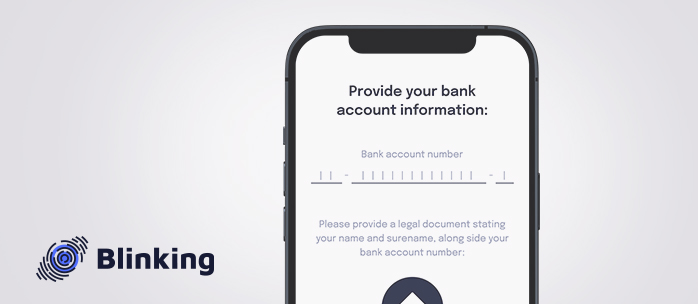

Using Blinking Identify solution, we have applied advanced AI technology to automatically check the validity of citizens’ personal documents, confirm documents’ ownership using biometric characteristics, as well as to automate process management while requesting a service or a product.

The whole process, including real-time video identification and digital document signing, can be completed online, without going to the bank.

Apart from safety and data security, key advantages of Blinking Identify solution are easy adjustment to different products and business processes, modularity and system ability to respond to digital challenges in the future.

A digital bank, available for both new and existing clients, can be a unique bank’s answer to challenges, as well as a most efficient tool to keep and attract customers and take a leading position in the market. A happy customer will recommend you everywhere, wanting to express their satisfaction and tell about the high-quality service you have enabled them.

Meet our consultants, who professionally optimize and automatize banking processes for years, raising the bar in the industry through their successful projects! Write to us with any additional questions, or if you want to schedule a digital bank demo.

Contact us