Digital Transformation

Industries

Services

About us

Insights

- Careers

- Resources

- Contact us

Inefficient and complicated processes can cause clients dissatisfaction. Today, clients want all banking products to be available online or at least fast – with minimum effort required. A happy customer will recommend you everywhere, thanks to the high-quality service you have provided.

Comtrade Onboarding & Accounts is a state of art solution available for Branch process and Remote onboarding with video identification, for both new and existing clients.

Solution portfolio

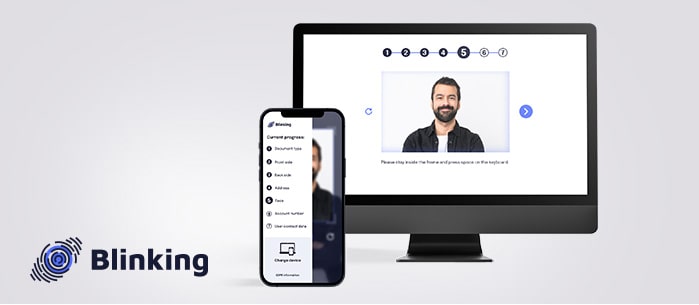

The digital bank was created in cooperation with Blinking company, whose technology allows development of complex banking products based on user identity confirmation.

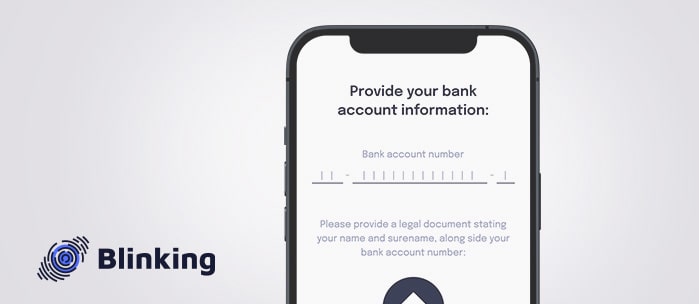

Using Blinking Identify solution, we have applied advanced AI technology to automatically check the validity of citizens’ personal documents, confirm documents’ ownership using biometric characteristics, as well as to automate process management while requesting a service or a product.

The whole process, including real-time video identification and digital document signing, can be completed online, without going to the bank.

Apart from safety and data security, key advantages of Blinking Identify solution are easy adjustment to different products and business processes, modularity and system ability to respond to digital challenges in the future.

Faster and simplified access to banking services

Make KYC processes faster through automation

Reduce the number of FTE for KYC procedures

From days to minutes

Manage all client interactions via multiple channels

Go paperless by integrating your KYC processes with an electronic signature solution

Store and manage all customer information using your existing CMS/DMS solutions

Set up KPIs for KYC processes

Create a set of automated rules and improve KYC process control

Meet our colleagues who have been professionally optimizing and automating processes for years, raising the bar in the industry through successful project implementation. Write to us for any additional questions or schedule a presentation of our solutions.

Contact us today